“My Bank Balance is Red and My Customers are Blue, please tell me B4, what can I do?”

Today for the less romantically inclined of you out there, is Valentine’s Day. Some regard today as a commercial gimmick, others a chance to shine or, if you’re a Tottenham fan, the chance to have a romantic break in Milan with a few mates.

The phrase ‘Roses are red, violets are blue’ (with numerous endings) will be well-worn today, but thinking about your business, could your bank balance be healthier and your customers happier?

Here are 5 tips to show your love for both your cashflow and your customers.

Turning your business bank balance from red to black:

- Review your expenses: Take a look at your business expenses and identify areas where you can reduce or eliminate costs, such as insurance charges, utility contracts and phone contracts. Many businesses will need far less lines and make significantly less calls than they did pre pandemic, so review your contract and, if it’s up for renewal soon, don’t sleep-walk into renewing on the same terms.

- Increase sales: Focus on increasing sales by promoting your products or services through marketing efforts, offering discounts, or creating new products. It’s easy to think borrowing is the answer to your cashflow woes, but you have to pay it back and it can be expensive. Generating new sales is good for business and good for your peace of mind. Consider offering customers deals to get them on longer term deals and offering incentives which don’t necessarily cost you but which will make them happy.

- Improve cash flow: Review your accounts receivable and accounts payable processes to ensure that you are collecting payments in a timely manner and paying your bills on time. There’s no doubt many businesses are extending payment terms to cover their costs. Be strong and make sure you have robust processes in place to make it clear your terms are your terms and they’re not to be abused. Also consider early repayment discounts for prompt payment.

- Renegotiate with suppliers: Consider negotiating with your suppliers to reduce costs or payment terms, which can help improve cash flow and reduce expenses. If you’re a loyal customer, you’d be surprised how open your suppliers will be to extending credit terms with them. But also make sure you’re not paying over the odds and get some quotes from competitors to check you’re not paying above market rate.

- Seek financing: Explore financing options such as loans, lines of credit, or crowdfunding to inject cash into your business and help get your bank balance back in the black. As we said above, this is a quick fix and if you’re confident it won’t overstretch you it may well be the best option for you, but make sure you’re not paying too much in the long run.

Getting your customers to fall in love with you again.

- Respond quickly: Respond to customer enquiries, complaints, or feedback in a timely manner to show that you value their time and opinions. Turn negatives into positives. Some companies deliberately drop the ball so they can show how fantastic they are when things go wrong. Your customer wants to know you understand how important they are so treat them with love, care and affection.

- Listen actively: Listen actively to your customers and show empathy by understanding their needs and concerns. You know how annoying it is when you get passed around the houses when you make a complaint to, for example, a large telecommunications company and nobody takes responsibility. Sure, don’t suffer endless abuse from a customer who is more trouble than they’re worth but don’t forget it’s easier to make an existing customer happy than to go out and find a new one.

- Personalise the experience: Personalise the experience for your customers by addressing them by their name, offering personalised recommendations, or providing tailored solutions. We all like to be remembered, hopefully for the right reasons, so show your customers they care, but be consistent. If a customer recommends you, send them a handwritten thank you card.

- Exceed expectations: Go above and beyond by providing exceptional service, surprise gifts, or offering additional benefits to your customers. The worst thing you can do is over promise and under deliver, so the best you can do is promise what your customer wants but over-deliver. Make a mark!

- Ask for feedback: Ask for feedback regularly to show that you care about your customers’ experiences and use their feedback to improve your products or services. You’ll be surprised that not everything you do for your customers is valued, so concentrate on the products and services they want and cut out what they don’t…it will free you up to do more of things your customers value.

At B4 we’re lucky to have some fantastic experts in our community. Why not join us to benefit from regular seminars, webinars and great events and tap into an amazing group of experts. Contact richard@b4-business.com to find out more or check out our forthcoming events here: www.b4-business.com/event/

More in Business Services

Unipart announces financial results for the year ended 31 December 2023

Unipart delivers strong growth and revenues exceed £1bn

Intertronics acquires Dyne Testing

~ Surface measurement business now a wholly owned subsidiary of Intertronics ~

Owen Mumford acquires Empelvic

Owen Mumford Expands Pelvic Health Portfolio with Acquisition of Empelvic

From this author

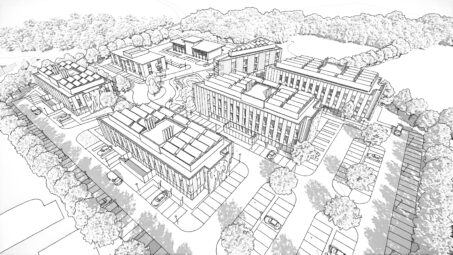

Wootton Science Park unveils £35 million masterplan for new SME science...

Hartwell Plc, the automotive and property development company, has unveiled emerging designs to deliver new carbon efficient lab and workspace buildings for small and medium sized science and technology companies and amenities at Wootton Science Park to the south-west of Oxford.

B2B Networking in the UK? Welcome to B4

Connecting Multisector Business Owners, C-Suite, Decision Makers

Unveiling B4 HUB: A New Era of Benefits for B4 Members

In the dynamic landscape of business, connections are the cornerstone of growth and success. At B4, we’ve always believed in the power of collaboration and support within our community. Only last week we saw the power of four of our Platinum Members coming together as the fantastic team at Sobell House stepped up the launch of the incredible OxTrail 2024 at Oxford Brookes University with the support of Darcica Logistics and Aston & James.