Carter Jonas: Farmland Market Update Q1 2021

Key data and expert commentary outlining key trends in the farmland market.

NATIONAL VIEW

Farmland values across England and Wales remained unchanged during the first quarter of 2021, reflecting a positive although uncertain sign for the market. Arable values averaged £8,450 per acre – a modest 0.3% rise on 12 months earlier – while pasture land values remained at £6,744 per acre, an increase of 0.2% on Q1 2020.

The lack of deals, and therefore transactional evidence of price increases or decreases, has maintained values at keen levels. The next three to six months will be a true test of the market, as historically, this season is when marketing for agricultural land and assets tends to begin.

Supply figures for Q1 appear to be more positive this year than they were during 2019 and 2020. Figures from Farmers Weekly recorded 7,300 acres of publicly marketed supply for the first three months of the year. This was more than double that of Q1 2020 and about 60% up on the same period of 2019. However, as seen in figure 2, supply is still depleted on the high volumes reached in prior years, but the increase this year is nonetheless a positive sign for both vendors and purchasers.

“We expect enquiry levels and viewings to progress as per a ‘new normal’ during the coming months”

Publicly marketed land is just one side of the coin and many vendors are opting to launch their assets off market or via auctions, to attract serious buyers which command, strong prices. Given these robust market fundamentals, the house and land market is showing no signs of abating.

Enquiries for assets with a leisure or alternative use component have increased in recent months, and when such assets are launched, on or off market, high volumes of interest are recorded. Alternative uses have always been desirable, particularly in locations where transport links and accessibility are good, and this desirability is likely to increase further as we transition into a post-subsidy world. Furthermore, interest from non-farming purchasers looking at land from a Natural Capital or habitat creation aspect is also growing, and we will continue to monitor how this evolves over the coming months.

Another trend evident is a decrease in rollover buyer enquiries, which appears to have slowed during the last three months. However, it remains too early to determine whether this will continue, as it may just be in a seasonal dip.

With the Covid-19 vaccination programme in full swing, and lockdown restrictions on course to ease, as outlined by the UK government in February, we expect enquiry levels and viewings to progress as per a ‘new normal’ during the coming months. Though conversations have been temporarily paused, we hope more clarity on Brexit and the UK’s Agricultural Bill to be firmly on the agenda, allowing businesses and occupiers to plan for the inevitable changes that will be introduced.

More in Commercial Property

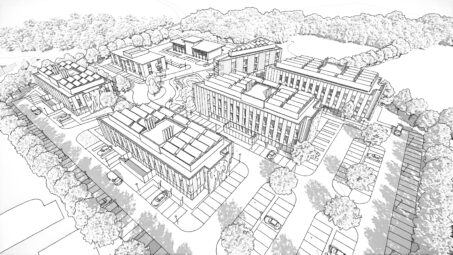

Wootton Science Park unveils £35 million masterplan for new SME science...

Hartwell Plc, the automotive and property development company, has unveiled emerging designs to deliver new carbon efficient lab and workspace buildings for small and medium sized science and technology companies and amenities at Wootton Science Park to the south-west of Oxford.

Green light for Bicester Motion’s new £50 million Innovation Quarter to...

Detailed designs for seven new, prestigious HQ buildings which total 212,030 sq ft (19,698 sq m) and will be built at Bicester Motion’s new Innovation Quarter have been given the green light by Cherwell District Council.

Oxford Innovation Space to manage £14m Vulcan Works Creative Hub

The high-end workspaces are expected to be available from early next year.

From this author

UK Biomass Potential for BECCS Land Occupier Survey

Carter Jonas have been commissioned to provide research and information on the future of Biomass and the potential supply of feedstock for power generation within the UK.

Are we overcoming the polarisation and prejudice that later living schemes...

In a 2018 article, we highlighted that communities are too often unbalanced and polarised and warned, ‘If age segregation is defining our communities today, then action must be taken to prevent it escalating further’. Three years on, Planning & Development Insite considers whether society and our industry has actually made any progress.

Biodiversity, Amenity and Diversification

The tree drivers for land purchases you may not have considered.